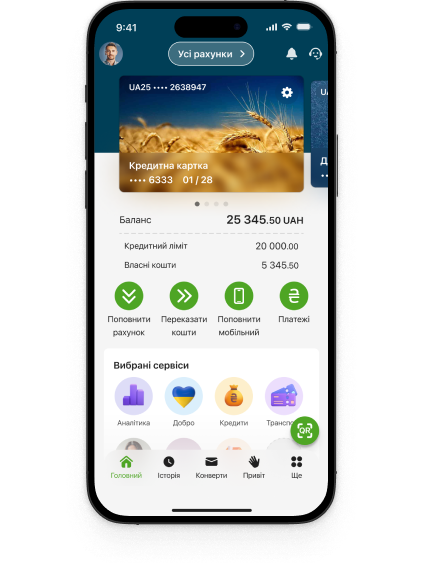

Envelopes: donations and savings

Envelopes - a new way to save and allocate your money. With Envelopes you can make donations and raise funds, save family earnings, manage your expenses to save money.

Benefits

- No fee for money enrollment.

- The incoming funds are allocated into different Envelopes (for example, “For groceries”, “For donations”, “For a dream”).

- Pay from your Envelope using Apple Pay or Google Pay.