Public Offer & General Agreement (for individuals). Valid for the period from November 11, 2022 until December 19, 2022.

Learn more

Public Offer & General Agreement (for individuals). Valid for the period from December 20, 2022 until December 31, 2022.

Learn more

Public Offer & General Agreement (for individuals). Valid for the period from January 1, 2023 until March 18, 2024.

Learn more

Public Offer & General Agreement (for legal entities). Valid for the period from November 11, 2022 until December 19, 2022.

Learn more

Public Offer & General Agreement (for legal entities). Valid for the period from December 20, 2022 until December 31, 2022.

Learn more

Public Offer & General Agreement (for legal entities). Valid for the period from January 1, 2023 until March 18, 2024.

Learn more

Information for customers in the wordings valid for the period from November 11, 2022 until March 18, 2024.

Learn more

Public Offer & General Agreement (for individuals). Valid from March 18, 2024.

Learn more

Public Offer & General Agreement (for legal entities). Valid from March 18, 2024.

Learn more

The website shall not be considered as the sole source of information for committing transactions in the capital markets. The tax mode depends on individual circumstances of each customer and may be changed in the future.

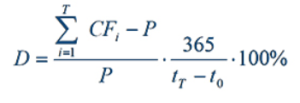

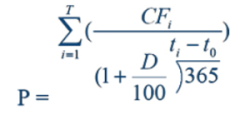

, where

, where , where

, where