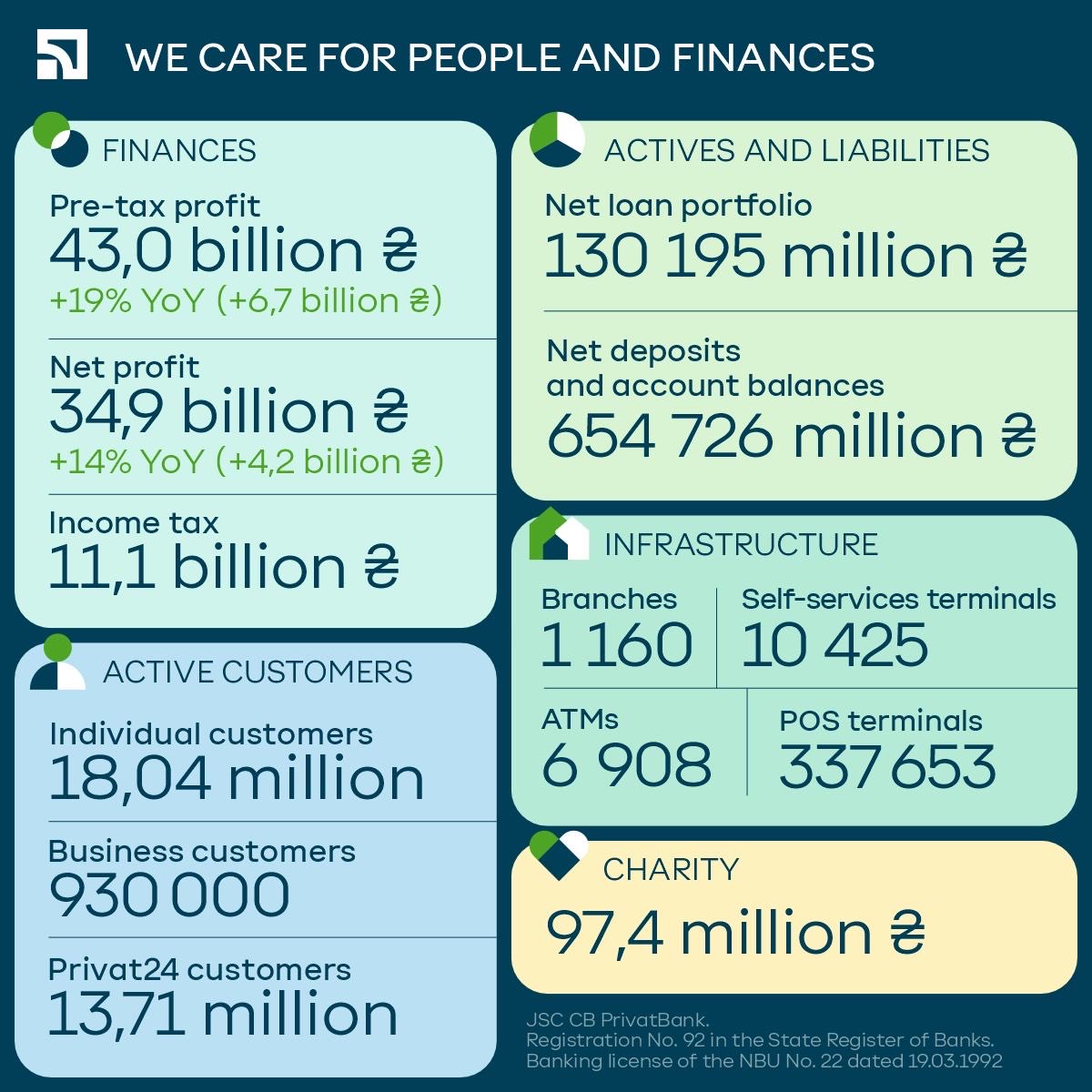

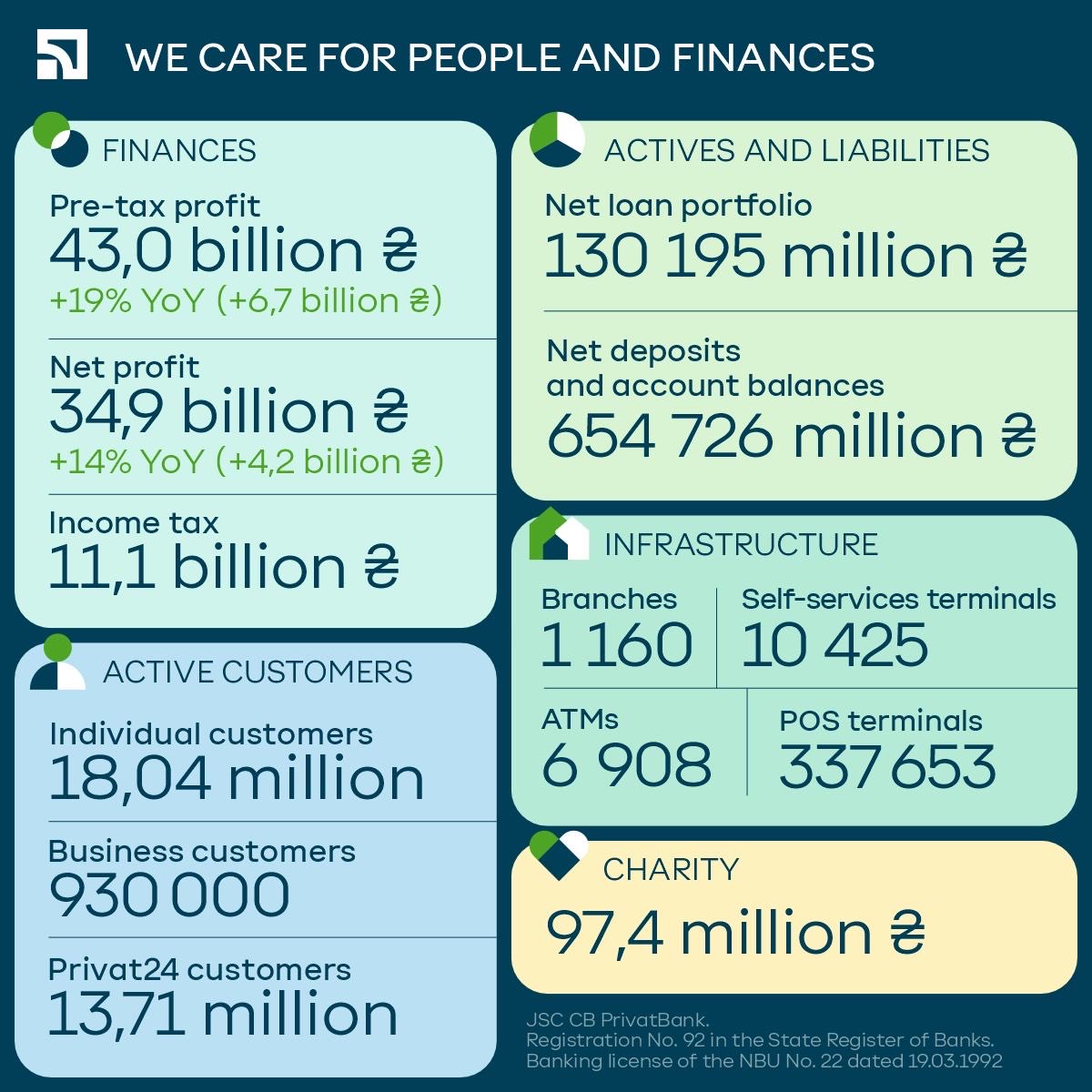

In the first half of the year, PrivatBank delivered a strong financial performance, reporting a net profit of UAH 34.9 billion after deducting 25% income tax. Business results without revaluations, reserves and taxes reached UAH 43.0 billion, an increase of 19% compared to the 1st half of 2024. These clearly indicate the sustainability of the chosen business model, the confident growth of operational efficiency, and the stability of the bank in the face of external challenges.

The Bank’s net loan portfolio expanded by UAH 17.4 billion, exceeding UAH 130 billion — a testament to our continued support for businesses and individuals across the country. Deposits from individual customers rose by UAH 58 billion, with total customer funds growing by nearly 13% over the past year, reaching UAH 487 bln. These figures reflect the enduring trust of the public and PrivatBank’s leadership in the Ukrainian financial sector.

The basis of such a successful financial result is stable and growing net interest (+18%) and commission (+7%) income compared to the first half of 2024.

Beyond financial performance, PrivatBank continued to lead in social responsibility and accessibility. In a landmark move, the Bank introduced Ukrainian sign language servicing in all branches nationwide. Twenty-seven branches were reconstructed to meet enhanced accessibility standards, ensuring inclusive service for all customers.

PrivatBank actively supported charitable initiatives and allocated UAH 97.3 million of its own funds for charitable and social projects.

“The results of the first half year once again prove that PrivatBank is more than a financial institution — it is a pillar of economic stability, a leader in the financial services market, and a trusted partner to millions of Ukrainians. Guided by our values, we restlessly enhance customer experience and serve to provide access to financing for the reconstruction and growth of Ukraine”, said Mikael Bjorknert, Chairman of the Management Board.

We care for people and finances!