PrivatBank closed 2025 with record growth across key financial indicators, reaffirming its status as the largest and most stable bank in the country. In a year of unprecedented challenges, the bank continued to support critical sectors of the economy, businesses and entrepreneurs, millions of citizens, while investing in innovation, digital infrastructure, and accessibility.

The key drivers of growth were increased customer trust and expanded financing of the economy. Funds of individuals exceeded UAH 500 billion, marking a historic high and demonstrating the bank’s stability and security to Ukrainians. The total volume of customer funds rose to UAH 731.6 billion, while the bank’s loan portfolio increased by 1.7 times, reaching UAH 156 billion. The large corporate business portfolio increased by UAH 11.3 billion over the year, fourfold.

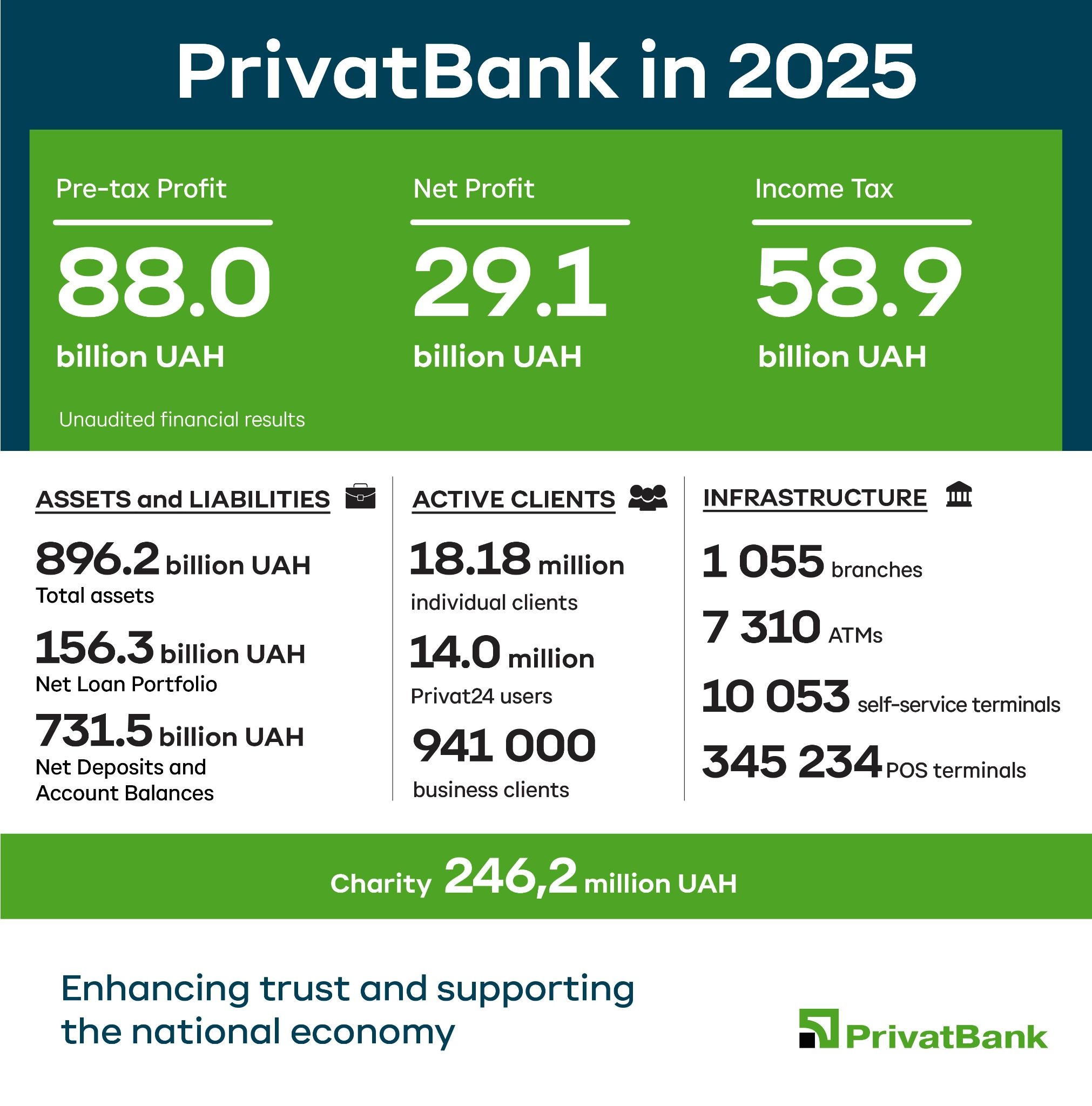

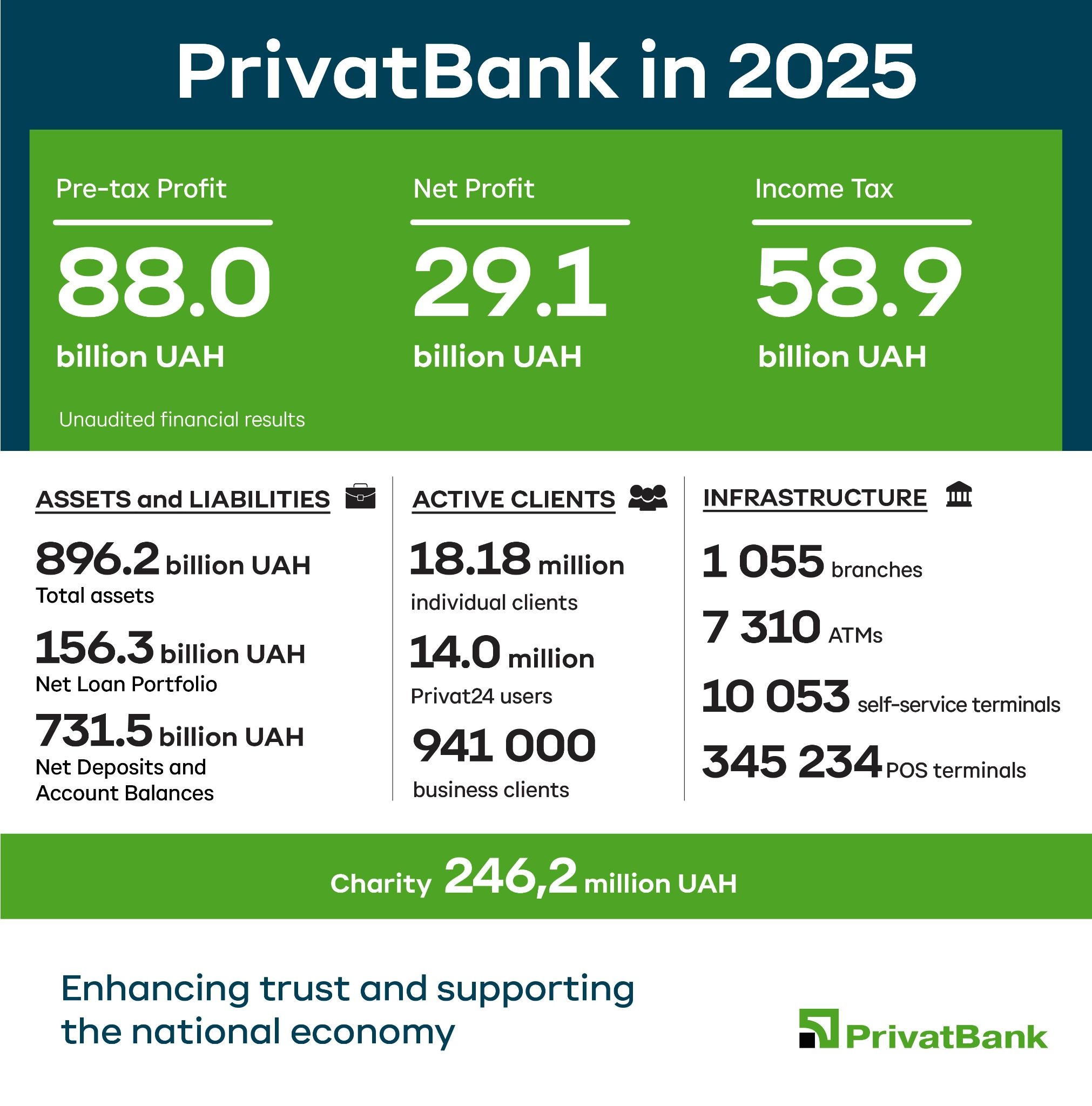

Profit before tax amounted to UAH 88 billion, which is UAH 6.9 billion more than in 2024. The Bank’s net interest income grew by 19%, which became one of the key factors in the year’s financial result.

In compliance with the main principles of the Lending Development Strategy, approved by the Financial Stability Council in June 2024, as well as in accordance with International Financial Reporting Standards (namely IFRS 9) and regulatory requirements, the bank ceased recognition of assets associated with former owners. The net carrying amount of these assets was zero. As a result of this derecognition, the share of NPLs in the total portfolio decreased from 59.4% to 10%. It is important to note that the derecognition of assets does not mean debt forgiveness. Following nationalisation, the Bank built a high-quality loan portfolio, with non-performing loans at just 3.5% - one of the lowest in Ukraine and comparable to those in developed economies.

Also, in line with the Tax Code, the bank accrued additional corporate income tax liabilities in the amount of UAH 37.5 billion. Thus, based on the results of 2025, approximately UAH 59 billion of corporate income tax will be transferred to the state budget of Ukraine, which makes PrivatBank the largest taxpayer among banks.

The Bank’s profit after deducting income tax amounts to UAH 29.1 billion.

PrivatBank has significantly strengthened its international cooperation in 2025. Key achievements include the largest risk-sharing agreement in Ukraine’s financial market with the EBRD, reflecting strong international confidence and support and unlocking € 6 million in financing for business. In addition, at the end of the year, the bank concluded two more major agreements - the International Finance Corporate (IFC) and the European Investment Bank. In total, throughout the year, 12.1 thousand small and medium-sized business clients received loans for UAH 24.5 billion through international support programs.

In 2025, the bank also strengthened its social mission. PrivatBank allocated UAH 246.2 million to charity, supported medical institutions, the military, and communities, and implemented 16 large scale charitable projects. As part of its accessibility initiatives, the bank transformed 50 branches into more inclusive spaces, introduced remote sign language consultations in all branches, and made the Privat24 app and website more accessible for people with diverse needs. The bank’s achievements were highly recognized both nationally and internationally — PrivatBank received awards for inclusivity, innovation, and social impact. It was also highly recognized by national and international organizations, including FinClub, Euromoney, and the UN Global Compact in Ukraine, for financial leadership, inclusivity, and social contribution.

“2025 proved that PrivatBank significantly contributes to the economy, business, and society. We actively lend to critical sectors, create innovative services, support people, and support the country during a challenging time” said Mikael Björknert, Chairman of the Bank’s Management Board.

With a strong balance sheet, record customer trust, and systemic social impact, PrivatBank is confidently entering 2026, ready for new achievements and further strengthening of Ukraine’s economic and social resilience.